Budget Day 2021 – What it means for the property industry

Budget Day 2021 was among one of the most highly anticipated budgets we have seen.

Yesterday, chancellor Rishi Sunak unveiled plans to boost the UK economy with £65bn for businesses and workers affected by COVID-19. The effects of the pandemic can be felt worldwide with a huge knock-on effect on many countries’ economies. For the UK alone, The Office for Budget Responsibility (OBR) reports that government borrowing is at £355bn for the current financial year (April 2020 – April 2021).

With the relaxation of restrictions on the horizon, yesterday was a pinnacle moment for the UK economy.

The Housing Market

The housing market was given a huge boost on Budget Day 2021 with confirmation of two major lifelines.

An extension to stamp duty holiday until June 2021 and a mortgage guarantee scheme.

Stamp Duty Holiday

House buyers welcomed the news that the stamp duty holiday has been given an extension. It means that anyone buying up to £500,000 before the end of June will not pay tax. Savings can be up to £15,000, with a reduced rate available until the end of September.

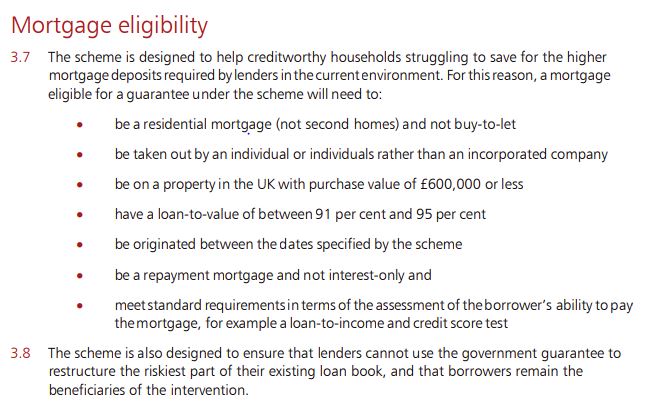

Mortgage Guarantee Scheme

Home ownership has been felt far out of reach by buyers since the pandemic began with lenders pulling back low-rate mortgages.

However, yesterday The UK’s five largest banks have signed up for the new government scheme that aims to help first-time buyers. The banks, Natwest, Santander, Lloyds Banking Group, HSBC and Barclays, will offer to lend up to 95 percent of the property’s value from next month.

The national average asking price of a first-time buyer property was £200,692, reported by Rightmove last month. This means a 5% deposit would be £10,035.

For our Nightingale Quarter site in Derby, it would mean that the buyer would need just £9,650 to be able to buy (plus any legal fees).

Other budget news

Taxes

- A rise in corporation tax to 25% from 2023 for businesses with profits over £250,000. A lower rate of 19% will apply to small businesses.

- VAT, National Insurance and income tax will remain at current levels, though the income tax personal allowance will be frozen rather than rise with inflation.

- Businesses that invest in new machinery will be able to claim 130% of the cost as a tax cut for the next two years.

- The stamp duty holiday will be extended until the end of June, meaning property purchases up to £500,000 will not incur the tax. From June until the end of September, the threshold will drop to £250,000, before returning to its original level of £125,000.

- The stamp duty holiday will be extended until the end of June, meaning property purchases up to £500,000 will not incur the tax. From June until the end of September, the threshold will drop to £250,000, before returning to its original level of £125,000.

- Fuel and alcohol duties were frozen, with planned increases scrapped.

Furlough

- Furlough has been extended until September

- Government to continue paying 80% of employees’ wages for hours they cannot work

- Employers to be asked to contribute 10% in July and 20% in August and September

- Support for the self-employed also to be extended until September

- 600,000 more self-employed people will be eligible for help as access to grants is widened

- £20 weekly uplift in Universal Credit worth £1,000 a year to be extended for another six months. Working Tax Credit claimants will get £500 one-off payment

- Minimum wage to increase to £8.91 an hour from April

Stay up to date by following our social media channels below.